Nature. Biodiversity. Healthy, functioning ecosystems.

These words don’t usually elicit a connection to the four-walled offices of CEOs or boardrooms where business decisions are made in companies around the world.

But believe it or not, these are exactly the topics executives should be bringing to boardroom tables in 2024 – and connecting to the operations of their companies, no matter the size, sector, or region they operate in.

Biodiversity is one of the hottest topics in the ESG world right now and for good reason—over 50% of the world’s GDP is moderately or highly dependent on functioning ecosystems—making it an extremely pertinent topic for businesses and their bottom lines.

What is biodiversity?

Biodiversity refers to the rich diversity of biological life on Earth, including diversity of genetics, species, and ecosystems found across the globe. These intricate pieces of diversity all rely upon each other in a ‘web of life’ system to maintain themselves and thrive. Like a ripple effect, the more diversity in genetics, species, and ecosystems, the more this diversity can be multiplied, and the stronger the overall system.

Simply, biodiversity allows for equilibrium in the natural environment. Humans—and businesses—rely intrinsically on this equilibrium to survive. Biodiversity enables ecosystems to provide us with those essential services such as clean air, water, and soil, which are the basis of our existence.

The problem

Since the industrial revolution, we have built our societies and livelihoods upon the exploitation of the Earth’s natural resources. The exponential growth of economies has since led to critical reductions in global biodiversity. Our land clearing, polluting, agriculture, and other large-scale human activities have been gradually unpicking the web of life system, with more than one million species currently at risk of extinction.

From an economic standpoint, the impact of intensive human activity on biodiversity poses serious threats to entire industries. For example, over-reliance on monoculture—the practice of cultivating a single crop species at a time—and other modern, intensive farming practices has led to sweeping vulnerabilities due to a lack of diversity. Disease, pests, and parasites that target species such as the Cavendish banana, citrus plants, or vital pollinators have put parts of the agricultural sector at risk of collapse. As continuous monoculture has been favored worldwide for increased efficiency, farmland and the ecological communities supporting it are increasingly losing resilience to threats, including climate impacts. Here, we can see the hugely important role that biodiversity plays in thriving economies and why it is becoming such a widely discussed topic today.

With the World Economic Forum now placing biodiversity loss and ecosystem collapse as the fourth most significant long-term risk for society, the business community is beginning to take notice of the potential implications of such risks on their operations and profitability. From issues like reductions in arable farmland, declining freshwater availability, and increased zoonotic disease prevalence to tighter environmental regulatory instruments, heightened stakeholder expectations to protect nature, and increased requirements to invest in nature-based solutions—companies in all sectors and industries have impacts, dependencies, risks, and opportunities (more on this later) related to nature that they must begin to address if they don’t want to miss the boat.

The good news is that the majority of large companies across the globe have begun to assess and manage very similar concepts with regard to climate change. Climate change and biodiversity loss are inextricably linked. Physical climate impacts such as droughts, heat waves, hurricanes, and wildfires have enormous impacts on the health of our environment. In addition, damage to natural ecosystems increases their vulnerability to climate impacts, with knock-on effects that exacerbate climate change itself. As companies have worked over the years to develop climate change strategies, net zero roadmaps, and stakeholder engagement programs surrounding climate, they have been laying the foundations to deal with a wider scope of environmental challenges which are now coming to the fore.

Where on Earth to start: A closer look at the TNFD

While nature and biodiversity may seem like overwhelming topics for businesses to begin wrapping their heads around, there’s never been a better time to get started with the wealth of resources now available for identifying, assessing, and monitoring nature-related issues – just like you do for climate.

In fact, just last month the final recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD)—a group established in 2021 with a mission to help organizations integrate nature into their financial and business decisions—were released. Marking perhaps the most significant point in time for the corporate biodiversity agenda so far, the TNFD’s recommendations are a fantastic place to initiate your organization’s journey.

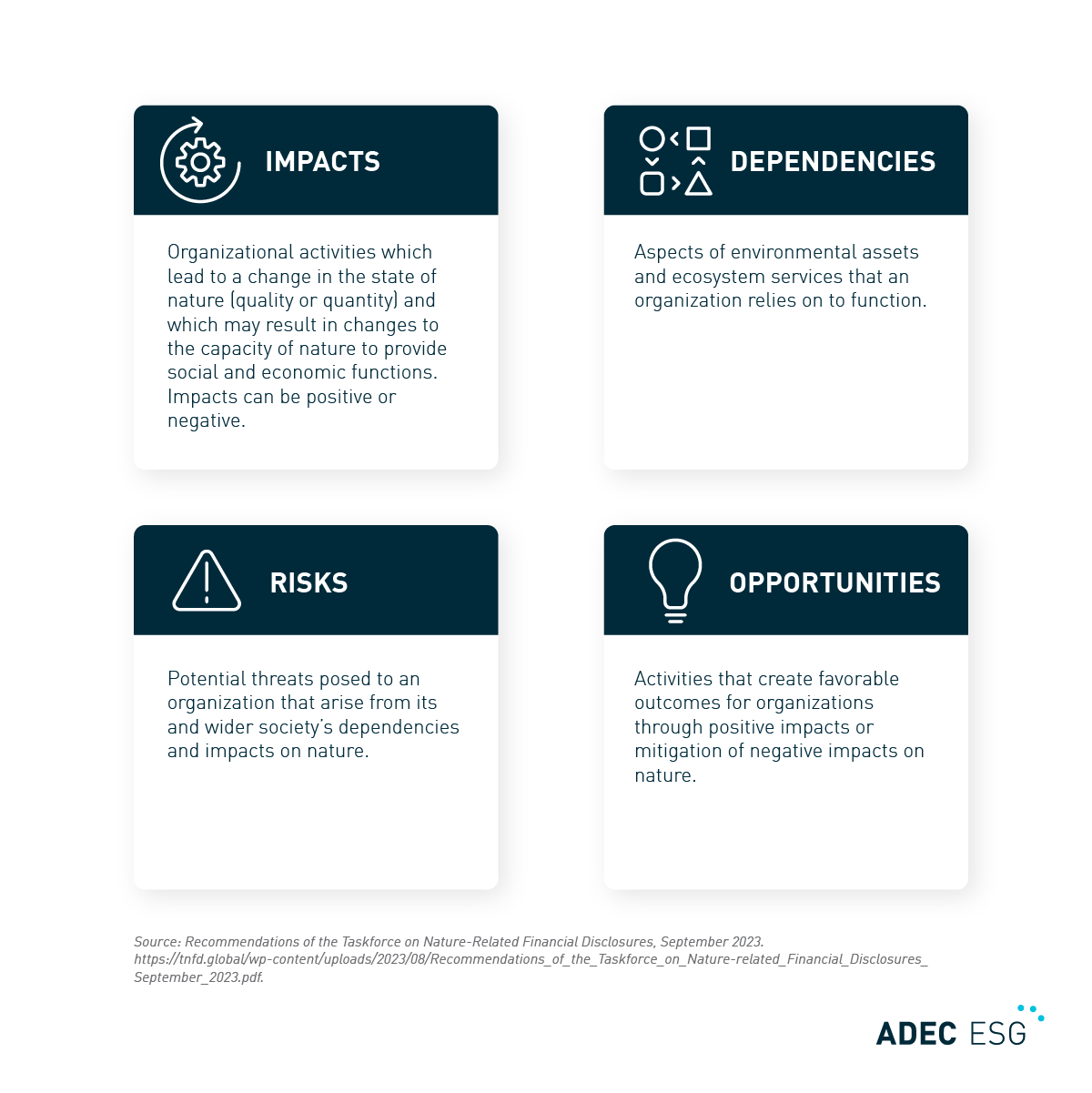

Let’s start with some basic terminology the TNFD has adopted as part of their recommendations. The following four terms are possibly the most fundamental to understand before delving deeper into the weeds of nature-related issues for business:

Impacts

Impacts are defined as organizations’ activities which lead to “a change in the state of nature (quality or quantity) and which may result in changes to the capacity of nature to provide social and economic functions.” Impacts can be positive or negative.

For example, consider:

- How does a company’s sourcing of ingredients and materials in its products impact native species, soil quality, and waterways?

- Is land cleared or degraded through the construction of physical assets and infrastructure?

- What air pollutants does the company release as a result of its activities?

- Do any of their activities conserve biodiversity?

Dependencies

Dependencies are defined as “aspects of environmental assets and ecosystem services that an organization relies on to function.”

For example, consider:

- Does the company depend on consistent water flow and water quality regulation to produce its products?

- Does it rely on the health of ecosystems to maintain and grow its investments in green projects?

- Does the regulation of hazards such as fires and floods, or the provision of suitable habitat for pollinators, enable the company to operate as normal?

Risks

Risks are defined as “potential threats posed to an organization that arise from its and wider society’s dependencies and impacts on nature.”

Risks can be:

- Physical risks (e.g., oil spills, pollution from pesticide use),

- Transition risks (e.g., shifts in consumer preferences towards more nature-friendly products/services, substitution of products/services with new technologies), or

- Systemic risks (e.g., loss of one species triggering a chain of others which leads to a loss of ecosystem services that businesses rely on).

Opportunities

Opportunities are activities that create favorable outcomes for organizations through positive impacts or mitigation of negative impacts on nature.

The TNFD groups nature-related opportunities into those of:

- Business performance (more external factors such as access to new, more eco-friendly markets, opportunities to develop new technologies or increase resource efficiency), and

- Sustainability performance (more direct actions the organization takes to conserve nature which benefit both the company, and society as a whole).

Understanding the four concepts above and starting to identify the linkages between them are crucial first steps for businesses looking to respond to the building momentum around nature in the corporate world. We can expect that over the next decade, corporate interactions with nature and biodiversity will become increasingly pertinent topics for organizations across the globe—and while the degree to which a company is affected will depend on its industry, the continued impacts of climate change and other environmental issues will ensure all companies are touched in some way by nature-related issues.

Stay tuned for additional blog posts in our Biodiversity series which will further break down TNFD’s guidance – such as conducting LEAP assessments and reporting on nature-related issues.

Nature and biodiversity: Building momentum

The TNFD’s Recommendations come at a pivotal time in ESG history, and many other regulators and reporting frameworks are following suit. CDP has included questions on biodiversity in their Climate Change disclosure since 2022. The European Sustainability Reporting Standards (ESRS) released their draft E4 standard for Biodiversity and Ecosystems earlier this year, and the International Sustainability Standards Board (ISSB) has received feedback to prioritize these topics as their S1 and S2 Standards are updated in coming years. Organizations should be keeping their fingers on the pulse of such emerging standards and regulations to ensure they’re prepared for the inevitable increase in scrutiny on these topics, alongside climate change.

In conversation with S&P Global on their ESG Insider podcast, the TNFD’s Executive Director, Tony Goldner, warns that companies should expect nature to take off faster than climate change has as a key ESG issue that stakeholders and regulators request information about. The two topics go hand-in-hand and one cannot be holistically managed without consideration of the other. It’s therefore crucial that – no matter how distant it may seem to the bank statements and investment returns of corporations worldwide – nature gets a seat at the boardroom table in 2024 and beyond.

ADEC ESG Solutions is a leading provider of sustainability solutions, including fully-integrated industry expertise, software solutions, and data management. To learn more about how we help companies like yours strategize around ESG and help organizations thrive amidst changing regulation, contact us today.