It is no longer a lofty idea supported by the few that executive pay should be, in part, influenced by ESG targets. In fact, according to a recent study by PwC, at least 45% of Fortune 100 companies have an ESG measure in their executive pay scheme.

A similar study by Willis Towers Watson in 2020 suggested this number was over 50% for S&P 500 companies.

This rising acknowledgment of the importance of achieving sustainability targets is a positive step towards shifting away from purely traditional key performance indicators (KPIs) to a more holistic view that considers some of the more pressing ESG challenges we collectively face. As Peter Drucker famously said, “What gets measured gets managed.”

But exactly how are these targets going to be set, cascaded, tracked, and monitored? Data, data, and more data will be fundamental to this exercise. Imagine, that executive pay is the very tip of an iceberg and that all reporting and disclosure is what is visible above the waterline. Like the iceberg, where 90% of the density is below water, so is it true for ESG reporting and disclosure, where 90% of the hard yards required to collect and wrangle the data into a meaningful structure for reporting is out of sight, below the waterline, seemingly inaccessible.

A phenomenon further validated by Harvard Business Review’s, The Challenge of Rating ESG Performance (2020), “There are no uniform requirements for reporting ESG information, and many environmental and social impacts are hard to measure. So the data inputs that we start with are fundamentally less structured, less complete, and of lower quality…”. Organizations that help implement Sustainatech (the application of data insight and software technology) such as ADEC can harness this data and make it meaningful for organizations and their stakeholders.

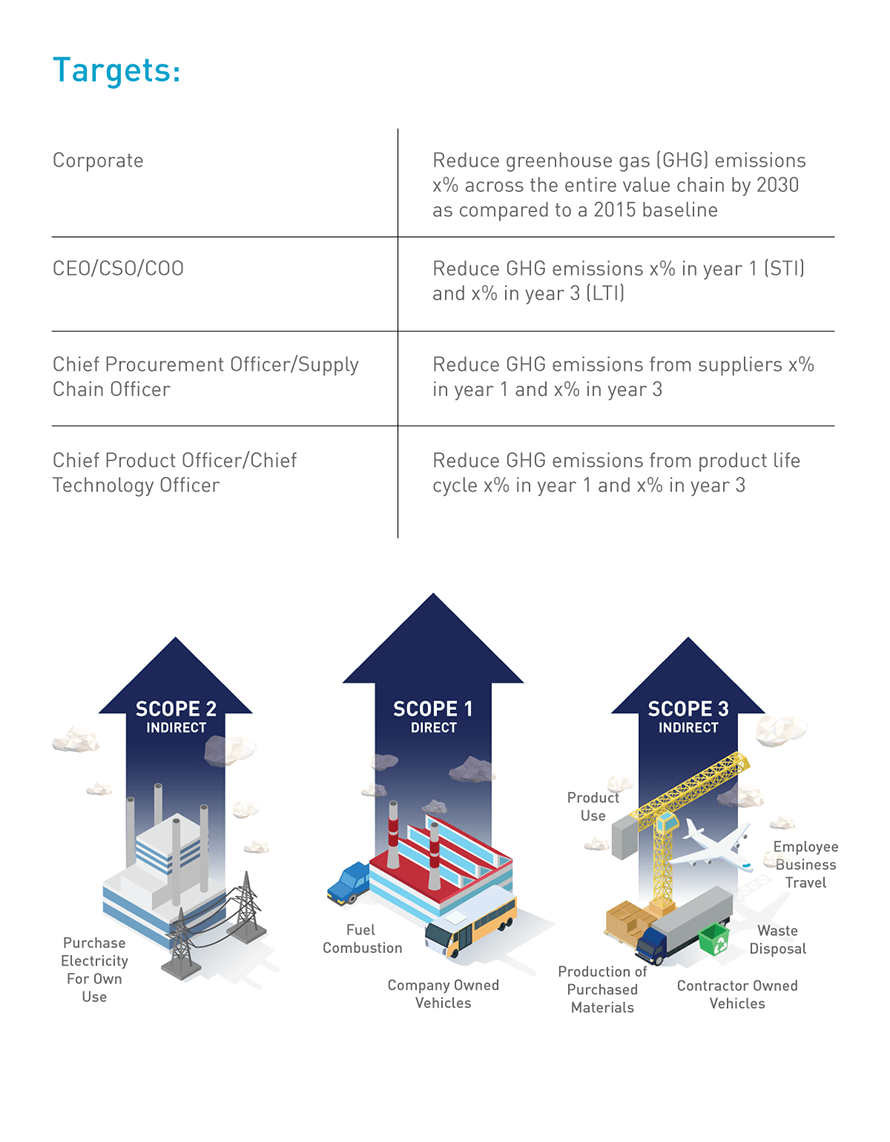

An illustrative example of this could be CO2 emissions. While still not the most common ESG metric linked to executive pay, CO2 emissions metrics are growing. As this is a strong focus for us at ADEC, I thought it would be useful to run through the following illustrative example (not a real one) of how an emission target might be set, cascaded, and measured for both short-term incentive (STI) and long-term incentive (LTI).

Setting the targets for executives has been identified by boards as one of the most challenging issues. Rightfully so, given that before you can set targets that are meaningful and measurable, an organization needs to complete the ‘below the iceberg’ waterline data. A process that requires the collection and inventory of all their Scope 1, 2, and 3 emissions, thereby setting a baseline. From there, the key contributors to the overall GHG emission profile of the organization can be identified and then targets set appropriately for executives who have control over the activities that are the key contributors.

One can easily feel paralyzed by the complexity that lies beneath the waterline of the iceberg, however, the most important consideration remains simply for organizations to begin their sustainability journey.

At ADEC Innovations, we help you get started by defining and narrowing your universe of data so that you can create an actionable plan to achieving your sustainability objectives. Find out more in our white paper, Mastering ‘Big Data’ in Environmental Sustainability.