It is every business’s responsibility to have a climate strategy, know their direct and indirect GHG emissions, and set targets to reduce them. The Inflation Reduction Act (IRA) of 2022 provides financial incentives for those who can contribute to the development of clean energy and reduction of emissions, laying additional groundwork for increased availability and access to clean energy.

In this increasingly more sustainability-focused world, businesses of all sectors are beginning to set climate targets and goals, respond to reporting indices, make more sustainable investments, and receive stakeholder feedback on ESG. In the United States, the IRA will provide many opportunities for all businesses to improve climate-related strategies and decisions.

U.S. Current State of GHG Emissions

Currently, the United States’ business-as-usual case has the country on track to reduce GHG emissions between 24% and 35% by the year 2030 compared to 2005 levels, whereas the United States Paris Agreement calls for the U.S. to reach a 50-52% reduction in GHG emissions by 2030.

While the IRA is a fantastic step in the right direction, with an approximate forecasted 40% reduction by 2030, it is not the end of the race. Rather than a complete solution, the IRA should be taken as a direct call to action for companies to set ambitious climate goals, invest in clean energy and regeneration projects, and choose to make bold commitments to boost their climate strategy.

IRA Impacts and Direct Benefits

The largest financial benefits from the IRA are available for companies that have resources to invest in clean energy solutions. Solar, geothermal, wind, closed- and open-looped biomass, landfill gas, municipal solid waste, hydro, marine and hydrokinetic facilities, and offshore wind development are supported by tax credits and financial support from the IRA.

The IRA has the potential to drive $3.5 trillion in cumulative capital investments in the new U.S. energy supply over the next decade, and to double the investment capital in wind and solar energy projects to $321 billion by 2030. Participating developers can receive a 30% investment tax credit for clean energy projects that strengthen this type of energy manufacturing and support the expansion of clean, domestic energy production.

Renewable energy development can help businesses achieve climate goals and boost social programs by providing opportunities to invest in, develop, and support projects in often underprivileged communities.

Renewable, clean energy production provides access to more environmentally sustainable consumption for businesses and individuals from all social backgrounds. The IRA provides tax incentives and funding for supporting less privileged communities with clean energy projects as follows:

- 40% investment tax credit for solar or wind projects located in low-income communities or on Tribal land;

- 20% investment tax credit for facilities that are a part of low-income residential housing or low-income economic benefit; and

- $17 million allocation from the EPA for low emission electricity partnerships within low-income and disadvantaged communities related to GHG emissions reductions.

Be aware of the opportunities your local grid and value chain have to switch to renewable energy consumption or participate in carbon offsetting.

Indirect Benefits of Clean Energy Development

The IRA also provides ample opportunities for businesses that may not have the capital to develop clean energy themselves. As GHG emissions monitoring and management become more widespread and standard practice, it is worth keeping an eye on the energy consumption choices of all your suppliers and value chain members.

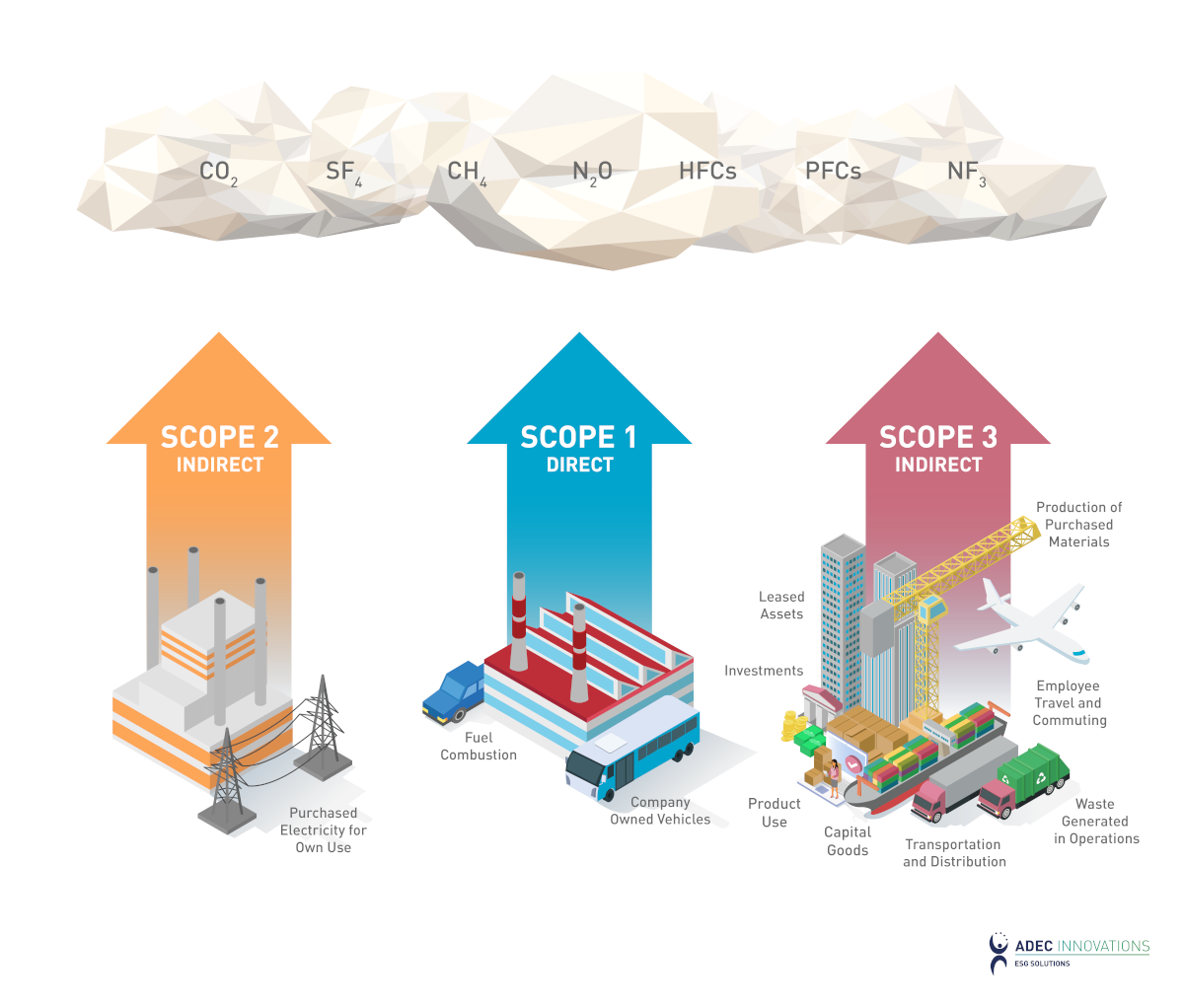

With so many opportunities for energy developers to move away from new fossil fuel discovery and towards renewable developments, it should be expected that there will be an increase in renewable energy availability. Be aware of the opportunities your local grid and value chain have to switch to renewable energy consumption or participate in carbon offsetting. See Figure 1 below as a reminder of all activities that are involved in the value chain, and learn more about how to engage your supply chain on scope 3 GHG emissions.

While the SEC is proposing climate change disclosure regulation and net zero goal-setting is becoming more commonly expected, businesses are left with an increasing level of financial and supply risk if they do not choose to source renewable energy. Sourcing renewable energy will reduce a business’ GHG emissions, and—with large-scale government support like the IRA—renewable energy sources will continue to increase in availability.

.png)

Additionally, the predicted increase in renewable energy availability and reliability should encourage businesses to set ambitious GHG emissions reduction targets and seek out a switch to renewable energy swiftly to boost their climate strategy.

Many reporting indices and stakeholders encourage companies to commit to some, if not all, of the following:

- Net zero targets

- Clean/renewable energy usage targets

- Methane reduction targets

- Disclosing scope 1, 2, and 3 GHG emissions

- Using low-carbon products

- Investing in emissions reduction activities

Other areas where the IRA promotes a reduction in GHG emissions—and can directly or indirectly aid in a business’ GHG emission reductions and overall sustainability journey—are:

- Agriculture and forestry: There are several programs included in the IRA that promote soils- and forestry-based carbon sequestration, with the intent of reducing GHGs from agriculture and improving the climate resiliency of farms and forests. This is an important discussion to have with your suppliers if they are in the agriculture or forestry industries.

- Methane reduction: In order to prevent a facility from breaching the maximum annual methane waste emission rate of 25,000 tonnes CO2e, the EPA is providing incentives, grants, contracts, loans, and rebates to enable methane emission reduction activities.

- Manufacturing facilities: Facilities that can reduce their GHG emissions by at least 20% are eligible for a 30% investment tax credit.

- Clean fuel: The IRA provides tax credits for private and commercial purchases of clean energy vehicles, an excellent opportunity when considering a company fleet upgrade.

Important Note for the Oil and Gas Industry

The IRA has a clear focus on providing more clean energy solutions, including significantly expanding offshore leasing for wind energy. However, as a condition of making these wind leases available, the Act also continues to provide oil and gas leases over large tracts of the outer continental shelf.

Although access to these new leases for the oil and gas industry is one of the largest compromises made in the IRA, the environmental benefits of the bill are seen to outweigh the cons.

To help tackle the impacts of the oil and gas industry—the IRA rewards choosing more sustainable options, and annual rates for new oil and gas leases are increased to discourage oil and gas expansion.

For industries like oil and gas, whose operations will inevitably continue to produce GHG emissions, it is still important to commit to GHG emission reduction and/or net zero targets. For endeavors that offset emissions, such as carbon capture and sequestration development, the Inflation Reduction Act will increase current rates per ton of carbon captured by a factor of five:

- Carbon capture companies will receive $85/ton of carbon captured and injected (currently $17/ton)

- Facilities that capture and use carbon will receive $60/ton of carbon (currently $12/ton)

- Companies with direct air capture facilities will receive $180/ton of carbon captured (currently $36/ton)

Conclusion

The exciting and hugely important Inflation Reduction Act should motivate businesses to commit to or expand their emissions reduction targets and feel confident that their climate action strategies can find growth and support from the Inflation Reduction Act.

ADEC ESG Solutions partners with global organizations to integrate environmental, social, and governance management into everything from long-term strategy to everyday operations. From emissions data management to low carbon transition strategy and implementation, learn more about how we can support you on your Sustainability Journey today.