We have entered a new era of sustainability and ESG regulation, moving rapidly from voluntary to mandatory corporate disclosures. In jurisdictions across the globe, governments are adopting legally binding ESG and climate-related disclosure regulations. Many registration and financial statements, legal filings, and investor and customer reports are also beginning to require emissions and climate-related financial disclosures.

Jurisdictional Requirements Assessment

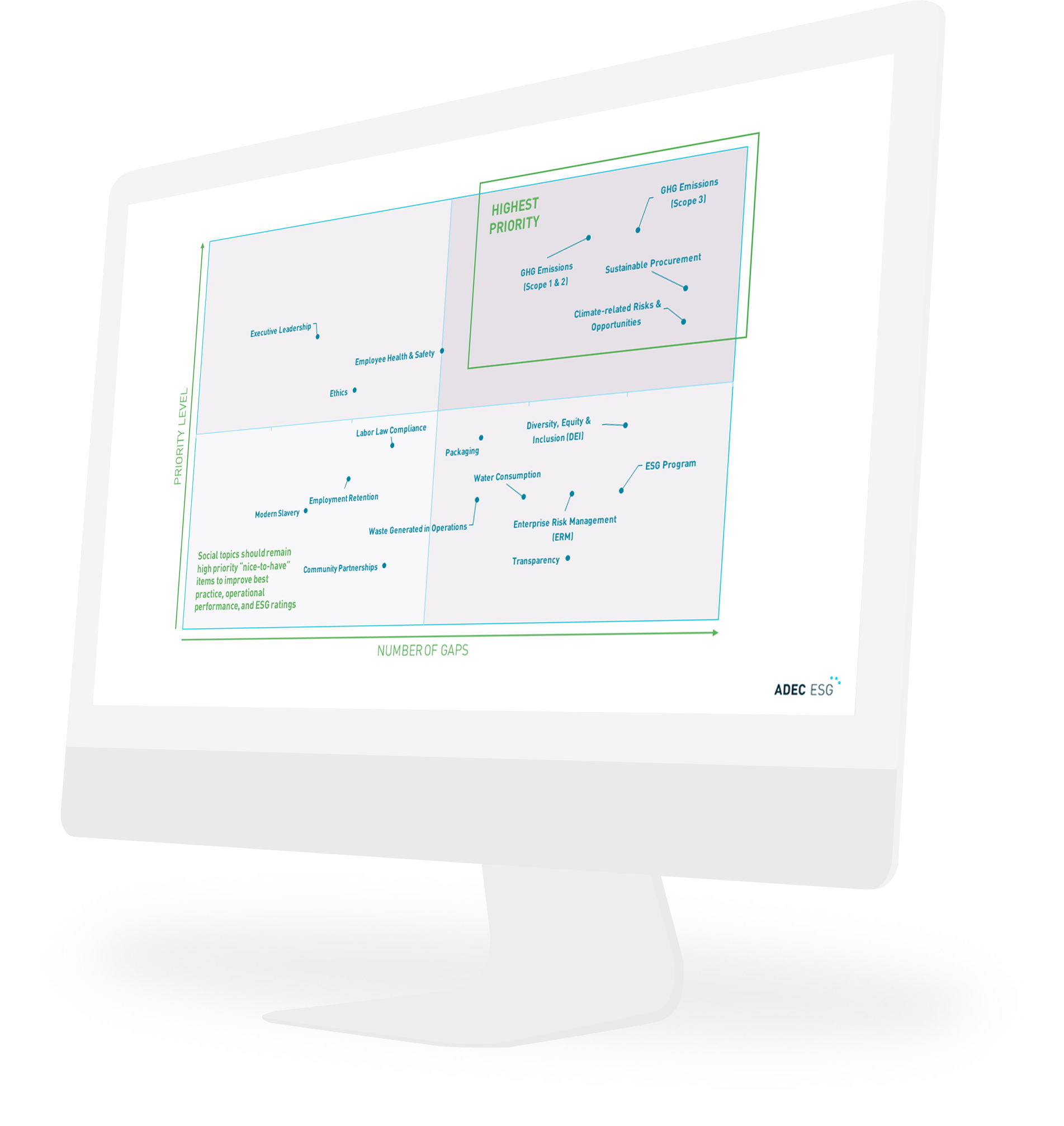

Gap Analysis and Insights

Recommended Actions

Using collected data, ADEC ESG will identify the jurisdictional applicability of current and emerging regulations. Once all applicable regulations have been identified, our team will review ESG and sustainability documents and reports against mandated reporting requirements. ADEC ESG will identify critical path gaps to be addressed and help you identify specific steps you can take to close those gaps. Finally, we’ll provide a roadmap that specifies required disclosure data, strategies to address gaps, and critical next steps and timeline for delivery, disclosure, and preparation.

While the focus of this work is to prepare you for mandatory corporate ESG disclosures, additional benefits include increased supply chain visibility, centralized data collection strategies, development of organizational metrics and targets, emissions inventory improvements, and climate-related risk identification.

ADEC ESG completed an ESG gap analysis for a global Fortune 100 technology company headquartered in the United States. The project analyzed key global regulations pertaining to the company’s priority ESG topics, including energy and emissions, waste, labor and human rights, Board and executive oversight, and risk management. The regulations covered included the proposed Securities and Exchange Commission (SEC) climate rule, European Sustainability Reporting Standards (ESRS), IFRS Sustainability Disclosure Standards, and the UK Climate-related Financial Disclosure Regulations (CFDR), among others. Presented to the Executive Leadership Team, the project culminated in an ESG Scorecard detailing current program gaps and prioritizing what immediate action items were necessary to satisfy regulatory and other requirements.

Client: Global Technology Company

Location: United States

Project Results and Deliverables:

ADEC ESG completed a targeted regulatory assessment for an Australian freight and logistics company, focusing on regulations at a national level. The scope of the project included both existing regulations such as the National Greenhouse and Energy Reporting (NGER) Act and the Modern Slavery Act, as well as pending regulation such as early draft proposals for the Australian Sustainability Reporting Standards (ASRS). This multi-phase project guided the client through a Sustainability Journey of its own, from a baseline assessment that helped establish a baseline on select ESG topics to a future state definition, which painted a picture of where the client hoped to take its ESG program. A gap analysis then informed the company’s critical path, which outlined the steps needed to take the company from its current state to its desired future state. The final deliverable provided general recommendations, detailed action plans, and specific roadmaps at the topic level, such as a Critical Path for Greenhouse Gas Emissions.

With buy-in from executive leadership, our client has begun implementing action items from its critical path, engaging cross-functional teams that work together to close gaps and act on recommendations to meet upcoming regulatory requirements at the national level.

Client: Freight and Logistics Company

Location: Australia

Project Results and Deliverables:

By accomplishing and submitting this form, you authorize us to collect and store your personal information, and to use and process them in connection with your application[s]. You also agree to keep your information updated by re-submitting this form or by emailing us here.

You agree to hold us free and harmless for any damage or injury that may arise from the collection, storage, or processing of your personal information. To know more about our Data Privacy Policy, please visit privacy-statement.

We advance

sustainable

practices around

the world.

ADEC Innovations would like the information in this website to be accessible to all our users. Anyone needing assistance or having difficulty