Do bonds and climate change mix? In this blog, they do. Let me explain why. In a world where “sustainability” is the latest battle cry, anything that is green, organic, net-zero, sustainable, energy efficient and the like, are typically well received by the market at large. Now, for businesses, cities and national governments to make their green initiatives work, or put up green infrastructures, they need money – and lots of it!

However, since it can take billions of dollars to make these green dreams come true, the entity dreaming big would need to borrow capital to start the worthwhile endeavor. Yet, no one bank or person is likely to be willing to cough up the whole amount. Therefore the project developer would have to borrow from several sources; and this is where the bonds come in.

However, since it can take billions of dollars to make these green dreams come true, the entity dreaming big would need to borrow capital to start the worthwhile endeavor. Yet, no one bank or person is likely to be willing to cough up the whole amount. Therefore the project developer would have to borrow from several sources; and this is where the bonds come in.

Bonds are essentially pieces of the whole loan. Any legal entity (that is a person, organization, city, or country) can buy bonds. At maturity, bond holders get their principal back while the interest is paid off at certain periods. This is why they are considered safer and are preferred by most investors.

A 2012 report commissioned by the Hong Kong and Shanghai Banking Corporation (HSBC) Climate Change Centre of Excellence, entitled Bonds and Climate Change: The State of the Market, answered questions about sizes, themes, regional markets, market outlooks and how the bond market in general is attracting a number of corporations. This is exactly what the climate economy needs to fuel its green infrastructures.

A 2012 report commissioned by the Hong Kong and Shanghai Banking Corporation (HSBC) Climate Change Centre of Excellence, entitled Bonds and Climate Change: The State of the Market, answered questions about sizes, themes, regional markets, market outlooks and how the bond market in general is attracting a number of corporations. This is exactly what the climate economy needs to fuel its green infrastructures.

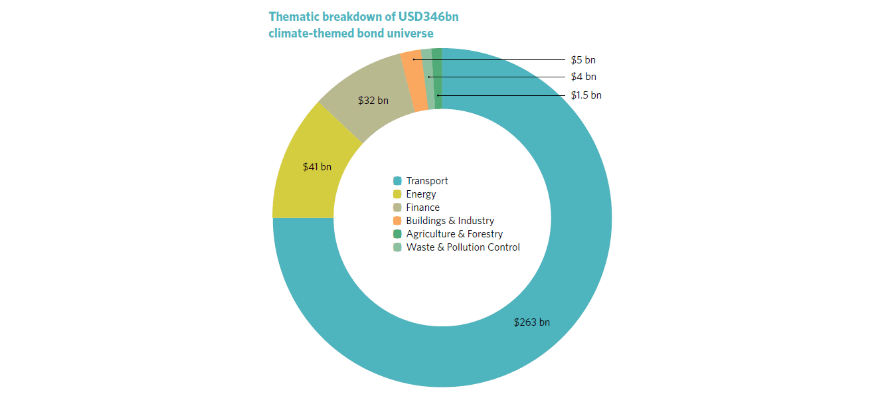

According to a CleanBiz.Asia article posted on June 17, 2013, climate-themed bonds almost doubled to $346 billion last year. The article, referring to the same HSBC commissioned report, further reports the bulk of the bonds that were issued by China ($127 billion) followed by the UK ($50 billion) and France ($41 billion).

These are going towards various sustainability initiatives and green infrastructures that are meant to build a low carbon and climate resilient economy. Dominating the climate-themed bond breakdown are Transport ($263 billion), Energy ($41 billion), and Finance ($32 billion). See figure 1.

To accelerate investor engagement and market expansion for climate-themed bonds, here are three key points identified by the Climate Bonds Initiative:

-

- Standardize What is Green – By standardizing and productizing climate products, the requirements of most mainstream investors are met through increasing the potential to scale up the green market.

- Support a Green Securitization Market–Through pooling together various types of receivables, banks can adapt and do more with their reduced allocations to project lending due to recapitalization pressures.

- Structure to Investment Grade – The objective is for the public sector to support policy guarantees, tax incentives and credit enhancements if targets for emission reductions are to be met; and for low-carbon assets to be developed at unprecedented speeds and scales. In turn, this would boost ratings to investment grade.

FirstCarbon Solutions (FCS) has a presence in the United States, Europe, Australia and Asia to keep our eyes on various sustainability efforts around the globe. Organizations and governments can benefit from our customizable products and services to minimize environmental impacts, optimize clients’ resources, and reduce costs to drive the green market forward. Click the button below for a free consultation.