As disclosure expectations for transparent climate reporting frequently change, the alignment between CDP (formerly the Carbon Disclosure Project) and the Task Force on Climate-related Financial Disclosures (TCFD) framework can offer a powerful pathway for companies to streamline sustainability disclosures. By leveraging this alignment, companies may reduce reporting burdens and produce more consistent, action-oriented information for their stakeholders and regulators.

This article explores:

- The basics of CDP, ISSB, the TCFD recommendations, and SB 261

- A question-by-question breakdown of how CDP aligns with TCFD recommendations

- Strategic recommendations on how to leverage CDP for reporting in line with TCFD and SB 261

A Pathway to TCFD-Aligned Climate Risk Disclosure

CDP is a global environmental disclosure platform that collects data from companies, states, regions, and cities on climate change, water security, and forests-related issues. It’s widely used by investors and major buyers to assess environmental risks and benchmark corporate performance, making it one of the most influential voluntary reporting platforms to date. Widely regarded as a global benchmark for environmental action transparency, CDP’s rigorous climate change questionnaire has been aligned with TCFD recommendations since 2018.

In 2023, the TCFD’s responsibilities were formally transferred to the International Sustainability Standards Board (ISSB). Formed by the International Financial Reporting Standards (IFRS) Foundation in November 2021 at COP26, the ISSB is an independent standard-setting body with a mission to develop a global baseline of high-quality, investor-focused sustainability disclosure standards.

ISSB builds directly upon TCFD’s four-pillar structure and integrates TCFD’s core recommendations into its global sustainability disclosure standards. The ISSB develops global sustainability and climate disclosure standards that provide consistent, comparable, and decision-useful information for investors. Their role is to unify and streamline sustainability reporting worldwide by creating a common baseline that regulators and companies can adopt. ISSB’s oversight means that embedding TCFD’s recommendations into its IFRS S2 standard (climate-related disclosures) can make climate reporting simpler, helping companies focus on meaningful disclosure rather than navigating overlapping frameworks. This aids companies, given the high rate of uncertainty and changing nature of multiple frameworks, especially in the wake of mandatory disclosures and regulatory requirements. One such example is SB 261.

Signed into law last October 7, 2023, California Senate Bill 261 or SB 261 (formally the Climate-Related Financial Risk Act) requires businesses with annual revenues over $500M USD operating in California to publicly disclose the climate-related financial risks they face and the actions they are taking to manage or adapt to those risks.

Under SB 261, disclosures must follow the recommendations of the TCFD or ISSB, the latter being the foremost standard for climate-related financial disclosures.

Companies required to comply with SB 261 must publish a climate-related financial risk report which describes the company’s climate-related risks, including both physical risks (such as extreme weather) and transition risks (such as policy or market changes), and explain how the company is managing these risks, along with relevant metrics and targets. Once completed, the report must be posted on the company’s website and a link submitted to the California Air Resources Board (CARB). These requirements aim to improve transparency and help stakeholders understand how climate change may impact a company’s financial health.

Initially, the first report under SB 261 was due by January 1, 2026, covering the prior fiscal year. As of writing, CARB has temporarily suspended this reporting deadline following a Ninth Circuit injunction issued on November 18, 2025. It confirmed it will not enforce the deadline while the injunction remains in effect. CARB plans to provide an alternate reporting date after the appeal is resolved.

Since CDP’s climate change questionnaire already captures detailed climate-related risk information, it can serve as a good baseline to prepare for regulatory sustainability disclosure requirements.

As climate disclosure requirements evolve, California’s SB 261 and the global CDP framework are emerging as two influential forces shaping how companies may report on climate-related financial risks. Companies that respond to CDP, especially its Climate Change questionnaire, can use much of the same information to follow TCFD reporting recommendations and meet SB 261 requirements, making the CDP climate questionnaire a practical tool for preparing or streamlining SB 261 compliance.

Mapping CDP Questions to TCFD Recommendations

Understanding how CDP’s questionnaire aligns with TCFD recommendations can help companies efficiently structure their disclosures and prepare for climate reporting regulations.

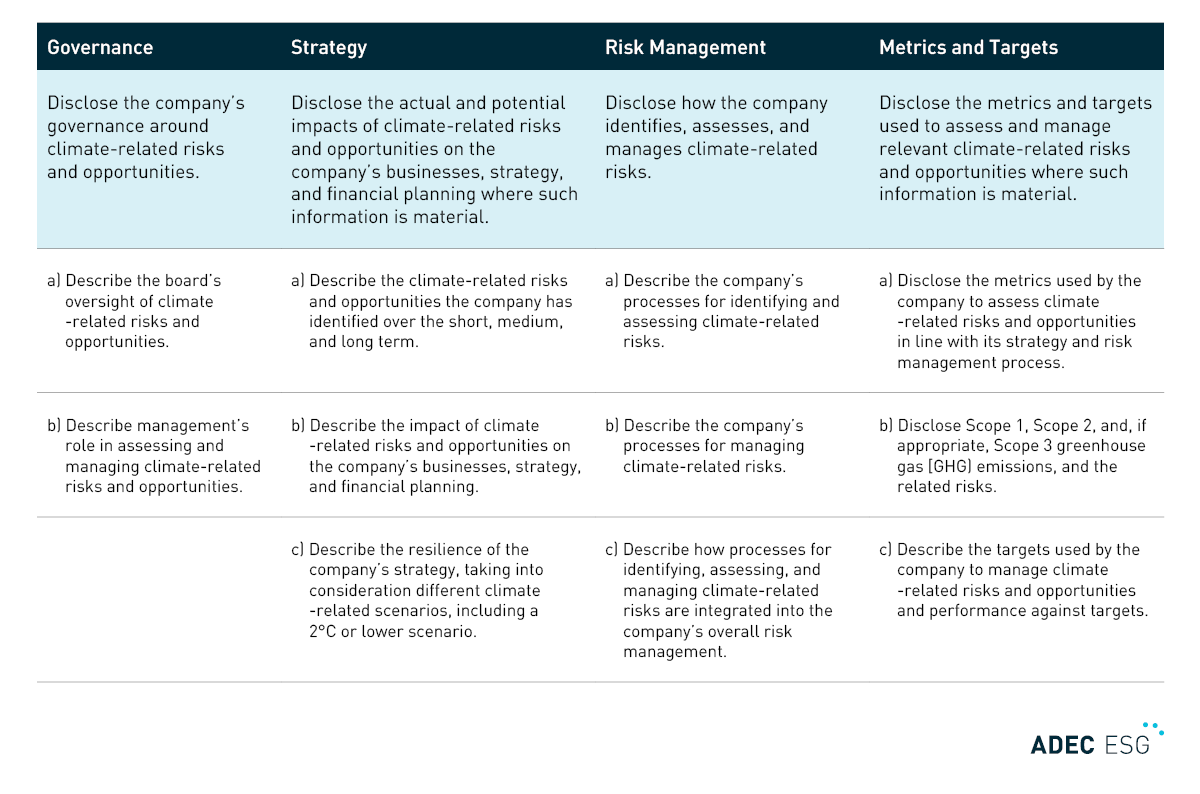

In their “Final Report on TCFD Recommendations”, the Task Force provides a mapping of the recommendations (Governance, Strategy, Risk management, and Metrics and targets) and recommended disclosures under each (a, b, c). CDP also provides a comprehensive mapping file that shows how the various CDP questions equate to corresponding TCFD recommendations or sub disclosures.

Below are the CDP questions that are fully aligned with the TCFD Recommendations.

1. Risk Management Process

CDP Question:

- Module 2, Identification, assessment, and management of dependencies, impacts, risks, and opportunities: 2.2.2

Relevant TCFD/SB 261 Requirements:

- Risk Management (a, b, c)

- Metrics and Targets (a)

Information disclosed under CDP question 2.2.2 on how companies manage their environmental dependencies, impacts, risks, and/or opportunities captures the recommended disclosures under TCFD’s risk management and targets and metrics recommendations. Companies are incentivized to provide a complete description of their overall risk management, disclosing information such as risk types considered, risk management tools and methods used, partners and stakeholders considered, and value chain stages covered. The risk management process also covers companies’ processes to meet their climate targets, and their performance in terms of accomplishing these targets.

2. Disclosure of GHG emissions

CDP Questions:

- Module 7, Environmental Performance – Climate Change: 7.6, 7.7, 7.8

- Module 3, Disclosure of Risks and Opportunities: 3.1.1

Relevant TCFD/SB 261 Requirement:

- Metrics and Targets (c)

Under CDP questions 7.6, 7.7, and 7.8, companies are requested to disclose their Scope 1, 2, and 3 emissions for the reporting period, including for past reporting years, if applicable. Some companies disclose increased operational expenses due to increased emissions. Question 3.1.1 requests for information on climate-related risks which may be relevant to companies’ GHG emissions.esponses to these questions are pertinent information to be disclosed under TCFD’s Metrics and Targets.

3. Board oversight of climate risks and opportunities

CDP Questions:

- Module 4, Governance: 4.1, 4.1.1, 4.1.2, 4.2

Relevant TCFD/SB 261 Requirement:

- Governance (a)

Companies disclose information about their Board’s oversight on environmental issues, including the positions accountable, and any relevant climate-related competencies, in the first four questions of CDP’s Governance module. Data disclosed in these questions encapsulates the required information for the Governance (a) TCFD recommendation, regarding the Board’s oversight on climate-related risks and opportunities.

4. Climate impacts on business strategy

CDP Questions:

- Module 5, Business Strategy: 5.3, 5.3.1, 5.3.2, 5.4, 5.4.1, 5.4.2, 5.4.3

Relevant TCFD/SB 261 Requirements:

- Strategy (b)

Under TCFD recommendations for Strategy (b), companies must describe the impact of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. CDP’s Business Strategy module covers this requirement on questions related to organizations’ strategy, financial planning and accounting, and spending/revenue aligned with climate transition. The Business Strategy module focuses on companies’ forward-looking strategies and financial decisions driven by market opportunities, public policy objectives, and environmental corporate responsibilities.

5. Disclosure of climate targets

CDP Questions:

- Module 7, Environmental Performance – Climate Change: 7.53.1, 7.53.2, 7.54.1, 7.54.2, 7.54.3

- Module 3, Disclosure of Risks and Opportunities: 3.1.1, 3.6.1

Relevant TCFD/SB 261 Requirements:

- Targets and Metrics (c)

Although TCFD does not specify emissions-related targets under their Targets and Metrics (c) disclosure, companies can use the information disclosed in CDP’s module 7 on their existing targets. CDP questions 7.53.1 to 7.54.3 allow responders to report on their climate targets such as emissions reduction targets and net-zero targets. Furthermore, companies’ risks and opportunities disclosure in CDP questions 3.1.1 and 3.6.1 respectively provide detailed information on actions taken to mitigate risks or realize opportunities, including the timeframe, likelihood, and magnitude associated with the effects of the risk or opportunity. Climate risk and opportunity disclosure can help provide context for targets and why certain targets (i.e. emissions reduction) are critical.

| Comparison of Disclosures | |||

| CDP | TCFD | SB261 | |

| Reporting Requirements | Environmental impacts, risks, and opportunities to drive climate action | Climate-related financial implications of risks/opportunities identified within operations | Climate risks using TCFD, ISSB, or other regulatory frameworks |

| Required reporting timeline | Annual; disclosure runs from May-September | Variable | First disclosure by January 1, 2026, with biennial reporting thereafter. (Note as of writing: This is currently suspended and CARB will provide an updated deadline.) |

| Voluntary/Mandatory disclosure | Voluntary | Voluntary | Mandatory for companies doing business in CA and >$500M total global revenue |

| Estimated time needed to complete the questionnaire/report | 2-3.5 months | 1-2 months | 1-2 months |

| Ways to Report/Comply | Completion of CDP Questionnaire submitted to CDP Portal | Publish a report aligned with TCFD recommendations | Publish a TCFD/ISSB-aligned climate financial risk report every 2 years |

Strategies to Leverage CDP for SB 261

CDP has been fully aligned with TCFD since 2018. As evidenced by the level of alignment between CDP’s questionnaire and the TCFD recommendations, companies that have already disclosed to CDP, or are preparing to, are significantly more prepared to meet SB 261 requirements.

Below are practical ways for companies to leverage their CDP responses:

- Reuse of Existing Data: CDP’s Climate Change questionnaire already collects TCFD-aligned information on governance, strategy, risk management, and metrics, which are the core reporting elements under SB 261. Companies can repurpose much of this information instead of starting from scratch.

- Structured Reporting Framework: CDP provides a globally recognized and well-organized framework for climate disclosures. Using the CDP questionnaire ensures that SB 261 report submissions are consistent with TCFD principles.

- Gap Analysis: With companies’ CDP responses, they can readily identify the responses or data to report for each TCFD recommendation to meet SB 261 requirements.

- Stakeholder Transparency: CDP data reports are widely recognized by investors. Furthermore, CDP supports informed decision-making through comparable climate data that can be easily analyzed.

- Updated Information: Since CDP reports are submitted annually, companies can maintain an updated repository of climate-related information, thus aiding their compliance with the biennial SB 261 reporting deadline.

By leveraging CDP’s TCFD-aligned questionnaires, companies can simplify the process of responding to SB 261, reduce reporting burdens, and deliver more consistent and transparent climate disclosures.

Whether developing your first CDP disclosure or strengthening your current response, ADEC ESG can provide expert guidance to support your reporting goals and maximize your CDP performance. Our team provides services fully customized to your needs, including:

- CDP Questionnaire Completion

- Scoring Assessments

- On-Demand CDP Support

- Regulatory and Supplier Reporting

- Annual Sustainability Reporting

- Sustainability Reporting Strategy

This blog provides general information and does not constitute the rendering of legal, economic, business, or other professional services or advice. Consult with your advisors regarding the applicability of this content to your specific circumstances.