In our Key Trends and Data from CDP in 2021 webinar, we discussed some of the insights uncovered while working with clients from across the globe on their CDP Climate Change, Forests, and Water Security disclosures this year.

Keep reading for some of the highlights, or watch the full webinar for all the details here.

ESG is calling for more detail, action, and progress.

The history of ESG goes back decades, and what started off as fairly basic reporting—energy data, GHG emissions data, and other metrics—has since transformed. Disclosing ESG data alone is no longer enough to meet many regulatory and investor standards.

In fact, market and regulatory drivers are requiring more detailed planning, performance monitoring, and commitments that demonstrate that organizations are enacting real, measurable change backed by science and supported by their own data.

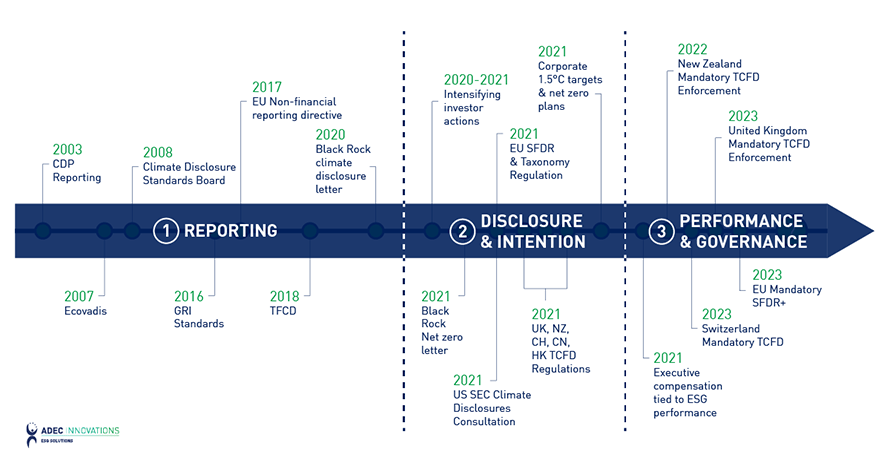

Glancing back at the last 20 years, we see that the evolution of ESG can be broken down into three relatively distinct periods, with each period requiring more data and deeper analysis, leading up to the ESG moment we’re in now.

Market and regulatory drivers are requiring more detailed planning, performance monitoring, and commitments that demonstrate that organizations are enacting real, measurable change backed by science and supported by their own data.

Reporting (2003-2018)

While the concepts of sustainability and reporting reach back further, this roughly 15-year period is a great place to start, as CDP first began conducting its annual surveys in 2003. At this time, companies were beginning their initial and often entry-level efforts to collect and present basic climate and other ESG information.

- Defined by voluntary reporting

- Flexible in terms of reporting content

- Prioritized presenting information in a way that was accessible to external stakeholders

Disclosure and Intention (2019-2021)

More recently, we see climate change and emissions formally recognized as serious risks to a company’s value chain. Many investors now ask for disclosure of ESG-related risks and plans.

We also see a marked increase in the number of companies supporting TCFD and disclosing to CDP, a number that has grown exponentially over the past few years.

- Increased rigor and formalization

- Greater expectations for strategies, plans, and statements from reporting companies

- Priority on target-setting (e.g., limiting warming to 1.5°C) and disclosure of risks

Performance and Governance (2021 and on)

The period that we’re entering—and that we’re likely to continue for a while—is marked by higher standards, investor scrutiny, and mandatory reporting. Investors (and some nations) are beginning to require detailed plans, performance monitoring, and governance commitments as evidence that companies are implementing actions.

- Plan development (net-zero, resilience)

- Implementation and systems development

- Change management and responsibility

- Greater standardization and large-scale reporting

Data collection and management should be key parts of your business.

As we move forward into an era of greater ESG performance, governance, and accountability, we see improved data availability and data quality becoming crucial parts of any strategy. The Performance and Governance era we are entering calls for requirements that are simply not feasible without a solid foundation of high-quality data that enables you to set meaningful targets, develop plans, create systems of change, and implement that change across your business.

Leading ESG companies demonstrate intention.

High ESG standards and ambitious targets aren’t easy to achieve. Companies that lead on ESG are taking careful steps to meet their goals, bringing both internal and external stakeholders into their plans for change.

Take scope 3 emissions, for example. In order to move towards 1.5°C scenario planning, ESG leaders are improving supplier engagement. The creation of these formalized communication channels and partnerships enables companies to work together with suppliers and vendors to make the changes needed to meet their targets.

Tying executive compensation to ESG performance is another way companies are taking intentional steps to make ESG strategy and outcomes a priority. This leading practice asks the highest levels of leadership within companies to be evaluated based on the company’s reporting success and progress year over year, integrating financial performance and ESG performance.

Get all the details on specific case studies and examples by watching the full webinar here.

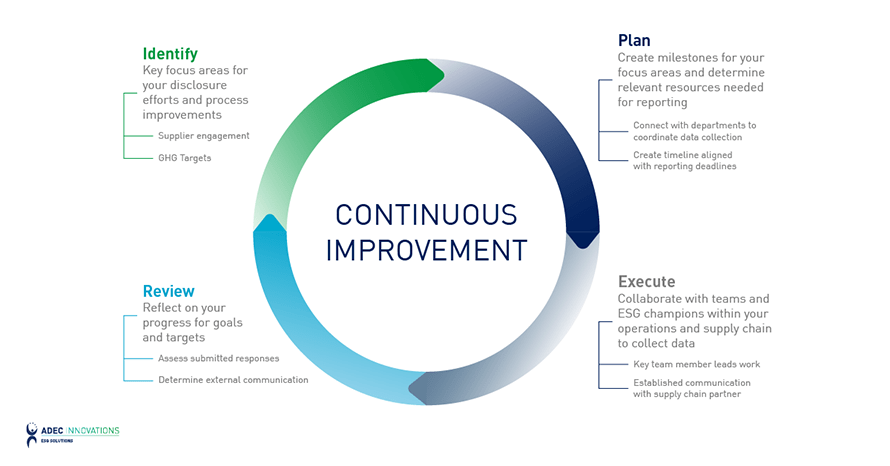

The cycle of continuous improvement is an essential aspect of your Sustainability Journey.

Like gears that create movement and push us forward, the cycle of continuous improvement is necessary to enact change and move you along on your Sustainability Journey. It isn’t only about moving from data collection and analysis to target-setting and implementation setting and implementation. Rather, in order to move forward, it’s important to look back, reflect, and take action based on previous progress.

First, identify your key focus areas, such as supplier engagement or GHG emissions targets.

Doing so will help you direct and plan out what the data collection process will look like, as well as establish a timeline that’s manageable within your teams.

To execute your data management initiatives, designate key internal and external collaborators and ESG champions to establish clear lines of communication between you and your teams.

Then, observe how your initiatives flow and review what changes need to be made and what changes will help you the most. While we recommend following many of the best practices outlined in the webinar, it’s important to remember that these changes and adjustments need to be unique to your business, your story, and your specific context in order to help you stand out as a sustainability leader.

ESG is a journey, propelled forward by continuous improvements both within the microcosm of individual organizations and within the greater global ESG landscape. While taking steps to reach higher standards as investors, government agencies, and other stakeholders call for greater change may feel daunting, intentional action built on a strong data foundation puts you in a great position to achieve your sustainability goals.

Want more than just the highlights? We take a deeper dive into each topic on the full webinar. Watch the recording, including a Q&A session with the audience, by clicking here.