Environmental, social, and governance (ESG) issues have traditionally been secondary priorities to corporations and their investors. For both executives and investors, pursuing sustainability had meant expending more resources for smaller gains. However, in recent years, there has been increasing stakeholder scrutiny on the sustainability of an organization’s operations and on how climate issues could impact their investment portfolios. Public markets have started regulating ESG disclosures in order to align organizations with stakeholder expectations, push for greater sustainability and resilience, and provide more transparency on progress towards ESG goals.

Additionally, more companies—both public and private—increasingly use ESG standards to meet stakeholder needs. For instance, the U.S. Securities and Exchange Commision (SEC) has recently released a proposal for public companies in the U.S. to report on material climate-related risks. A report from the Governance & Accountability Institute also revealed that 96% of S&P 500 companies published ESG reports in some form in 2021. This indicates that public and private companies are being expected to do more in terms of sustainability.

However, especially for organizations who have not yet developed a comprehensive ESG program, planning and implementing ESG initiatives will take time and effort. Reporting the progress and implementation of ESG initiatives is typically a year-long process and requires planning for an ESG strategy, measuring and verifying greenhouse gas (GHG) emissions, and publicly reporting to stakeholders. We’ll be diving into a few instances on how companies at different stages of their ESG journey can navigate the ESG landscape.

Example Case

The fictional organization we will be using to explain the ESG timeline is Company ABC.

Company ABC is a public organization in the U.S. and is classified by the SEC as an accelerated filer1.Their fiscal year ends on December 31. They have worked on ESG initiatives for several years. Although they do not consider themselves leaders in the ESG space, they have already incorporated a number of ESG initiatives and are working to improve on their sustainability. To report their progress in ESG, they annually respond to CDP’s Climate and Water programs and have reported their scope 1 and 2 GHG emissions for the previous reporting years.

For the next reporting year, Company ABC has decided to set a science-based target (SBT), which they are keen to include in their upcoming CDP disclosure. As part of setting an SBT, they will have to calculate their scope 3 GHG emissions in addition to scope 1 and 2 GHG emissions.

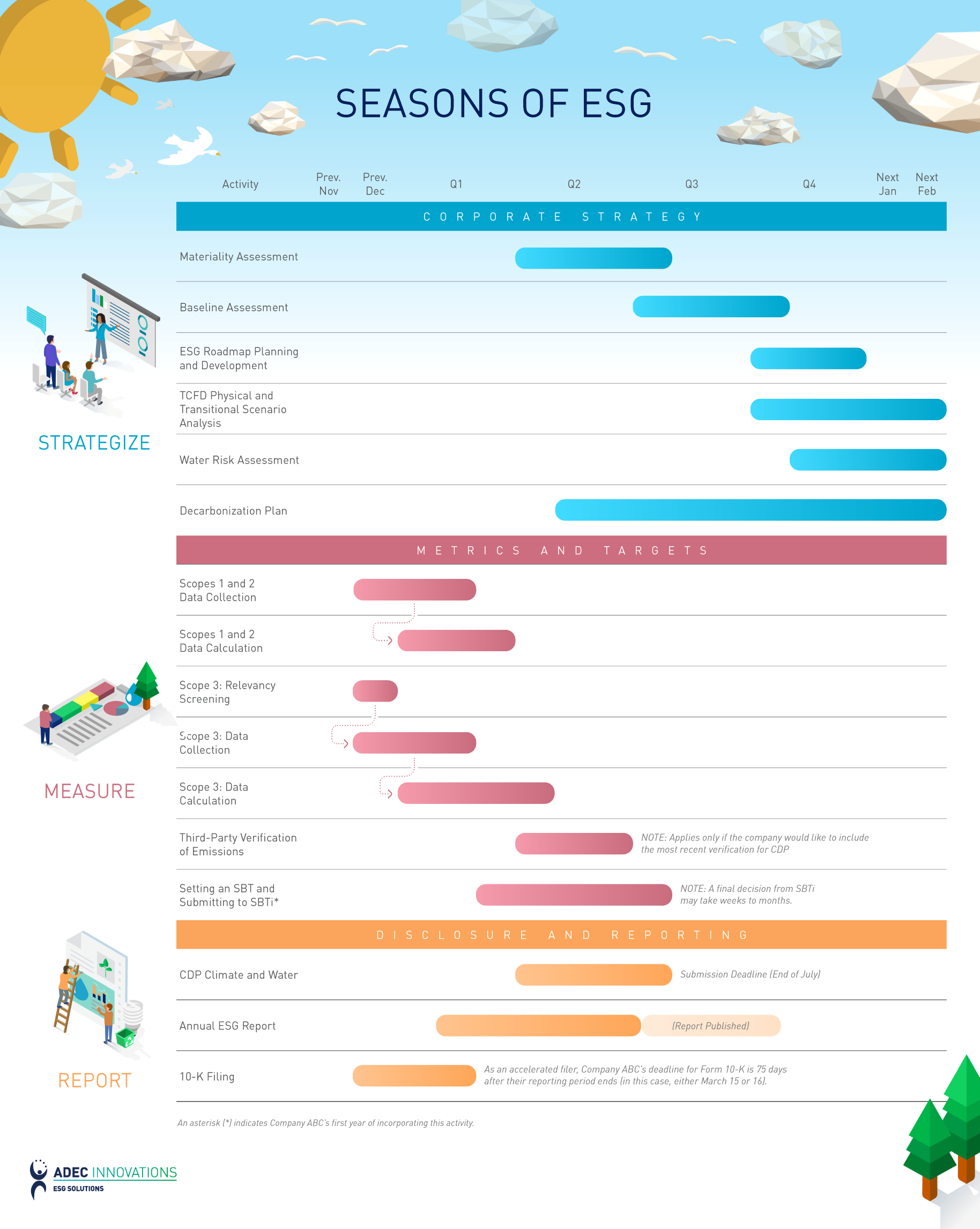

Considering the factors above, a rough example of Company ABC’s annual ESG initiatives timeline would look like this:

From here, we’ll break down the discussion into three key areas: corporate strategy, metrics and targets, and disclosure and reporting.

Corporate Strategy

Although planning and developing an organization’s ESG strategy can happen at any time in the year, a good time to start would be mid-year or after public reporting cycles. This allows Company ABC to prepare for upcoming necessary action: measuring GHG emissions and publishing ESG reports.

Some of the most common strategic ESG planning initiatives include:

Materiality Assessment

This initiative identifies which ESG topics are the most impactful, relevant, and important to the organization’s reporting, ESG, and business operations. Materiality assessment timelines vary by company. Critical aspects of a materiality assessment include:

- Design and scope

- Gathering, processing, and synthesizing data

- Analyzing the gathered information to identify ESG topics and identify actions and initiatives that can best strengthen and contribute to an ESG program and overall business plan

Gap Analysis

Companies should perform a gap analysis, which identifies gaps in current policies, procedures, and data systems that would need be addressed to meet reporting requirements. This includes understanding current stakeholder requests and needs as well as benchmarking industry best practices. This initiative may last an entire quarter.

ESG Roadmap Development

Developing an ESG roadmap includes setting goals and targets—such as science-based targets and net-zero targets—and identifying initiatives that will enable the organization to reach established targets. The organization may also choose to report these initiatives and goals in the next reporting year. This initiative should be revisited frequently throughout the year.

Other Corporate Strategy Initiatives

There are several other corporate strategy initiatives that can be extremely beneficial for organizations. Depending on the organization’s needs, these initiatives may include:

- Physical and transitional scenario analyses, wherein companies can predict and estimate the financial impact of physical and transitional ESG-related risks to the organization.

- Water risk assessments, which identify water-related business risks.

- Decarbonization plans, wherein companies look at their overall ESG plans and develop a plan for reducing/eliminating the carbon emissions of an identified material issue.

Metrics and Targets

After developing its ESG strategies, Company ABC will also need to annually develop GHG inventories to monitor progress towards emissions targets. The company should also report on the measured progress, strategies used, and initiatives that have been implemented throughout the reporting year.

This would include metrics and targets initiatives such as:

Data Collection

Organizations are highly encouraged to collect data on a regular basis throughout the year.

That said, we’ve allocated three months to data collection on our timeline for Company ABC’s GHG inventories. This includes determining activity sources that emit GHG emissions such as boilers, heaters, refrigerators, and mobile vehicles and compiling data from the identified relevant activity sources. If the company is working with third parties to develop their GHG inventory, this process should also include coordinating with the third party on missing and incorrect data.

Calculation of Scope 1, 2, and 3 Emissions

Especially in the company’s first year of reporting, calculating emissions will usually overlap with collecting activity data. This is due to data discrepancies and, often, missing facility data. This is the case for all scopes 1, 2, and 3 emissions.

Scope 3 calculation processes can vary dramatically across different industries due to how broad a company’s supply chain is. Consequently, the amount of data being calculated in the scope 3 inventory can stretch over the span of years, compared to scope 1 and 2 inventories.

Third-Party Verification

After an inventory is completed, getting emissions verified by a third party typically takes forty-five days (about six weeks) and includes a kick-off call for the verifier to understand the scope. Following the kick-off call, the verifier will make a verification plan and send data requests to the company, which will need to be fulfilled. The company and the verifier will need to coordinate on questions so that the verifier can audit the activity data, sources used for the GHG inventories, and assumptions and methodologies used by the company. The verifier will also present issues found on the inventory, some of which will need to be addressed before the verifier sends an inventory verification statement. Note that third-party verification will need to be completed in June of every year if the company wants to incorporate it for CDP disclosures.

Validation of Science-Based Targets (SBTs)

Science-based targets are one of the most commonly used targets in the ESG space, as they provide ambitious emissions reduction targets, which aim to encourage transformational action. Submitting and receiving validation for an SBT takes between four and six months if the organization is new to the submission process.

If Company ABC wishes to include its SBT in its CDP submission, we recommend starting the submission process in March to be able to submit a target to the Science Based Targets Initiative (SBTi) by mid-July. This process includes:

- Coordinating with third parties (if applicable) on GHG inventories.

- Identifying which scope 3 categories are relevant to the organization.

- Determining the science-based target that would make the most sense to align with.

- Submitting the target and waiting for the SBTi to either reject or approve the submitted targets.

Once submitted, the SBTi target validation team will validate the target against the SBTi criteria and the Target Validation Protocol. After several weeks, SBTi will inform the organization of submitted target approval or advise that the target be revised for another round of validation.

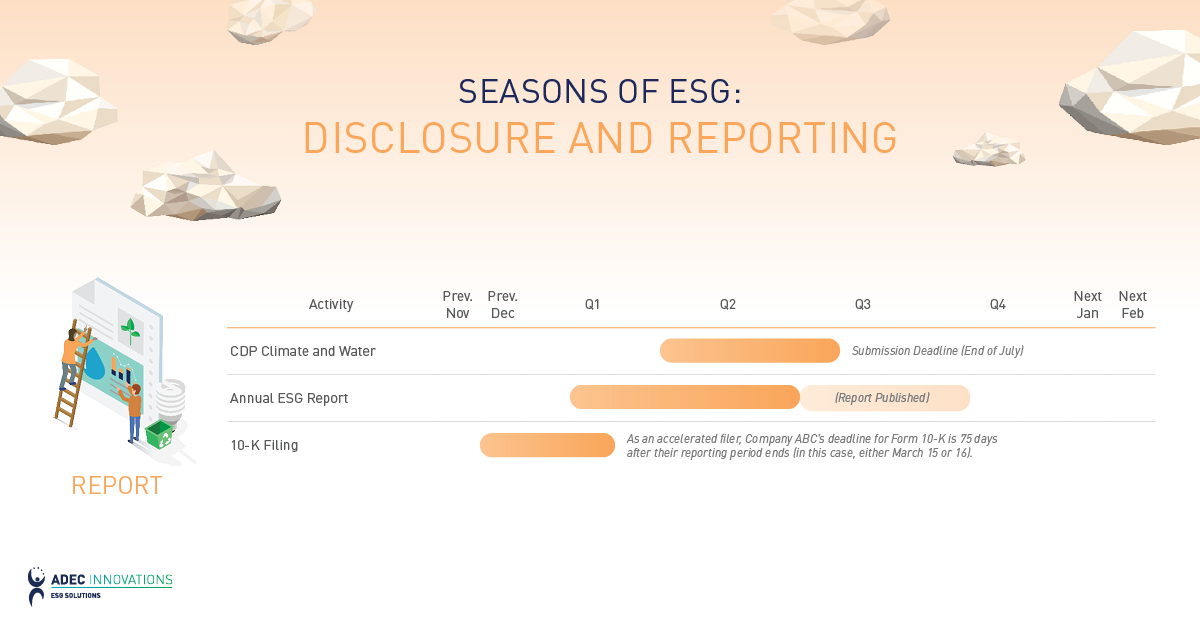

Disclosure and Reporting

Finally, the information gathered from conducting assessments, setting goals and targets, and developing and verifying GHG inventories can be reported to various frameworks. This includes aligning with ESG standards such as SASB, GRI, and CDP and ratings such as EcoVadis and MSCI-ESG.

Some of the most common ESG disclosure and reporting initiatives among participating companies are:

CDP Reporting

Preparing for CDP responses and disclosing required information typically starts when the questionnaire is publicly released in January or February. To make the process easier, companies can start gathering preliminary information right when the questionnaire is released and gather more specific information starting in March or early April, once CDP releases its updated methodology.

Required information includes the organization’s board structure, board involvement with ESG initiatives, ESG risks and opportunities, policies and procedures in place to address material ESG issues, and scope 1 and 2 GHG emissions. Given that CDP requests comprehensive information and its methodology can be very specific, the disclosure process can be time-consuming and will likely last until the submission deadline in July.

CSR and Sustainability Reports

Preparing and developing a company’s CSR report often takes the most time out of all mentioned initiatives, as it envelopes and reports on all actions taken during the reporting year. This process may take as long as three quarters (about nine months) to complete and includes:

- Planning and developing the CSR report outline

- Identifying key areas to report on

- Deciding the overall narrative for the report

- Identifying key stakeholders to include or support the narrative

- Data gathering

- Developing and publicizing the content

10-K Filing (U.S. SEC)

With the SEC’s 2022 proposed ruling on climate change disclosures, public organizations may need to include information on climate change-related material issues in their 10-K filing. A materiality assessment conducted in the previous year, which identifies climate-related material topics, may prove useful in completing this filing.

Assuming that limited assurance reports for GHG emissions are not yet required to be included in the 10-K, preparation for the 10-K filing process takes four months on average. This timeframe assumes that Company ABC conducted its baseline assessments well beforehand and is otherwise well-prepared for its climate-related disclosures. The four-month timeframe includes preparing both climate-related and other documents for disclosures, drafting and auditing financial statements, and drafting the form 10-K. As Company ABC is an accelerated filer, their form 10-K filing deadline would be seventy-five days after the reporting period ends, which in this case is March 15 or 16.

Download Company ABC’s example timeline here. In a cycle of continuous improvement, Company ABC’S timeline for the following year may look very similar, but they—as any organization—should take some time to reassess how this schedule worked for them, where they faced challenges, and how they might adjust future timelines to better accommodate those challenges.

Every company’s Sustainability Journey is unique, with unique ESG programs, targets and goals, and vibrant organizational culture. While strong ESG strategies do require a lot of time and investment, the long-term strength and resilience that come from those strategies are well worth it.

ADEC ESG Solutions is a leading provider of sustainability solutions, including fully-integrated industry expertise, software solutions, and data management. To learn more about how we can help support your ESG programs and initiatives, explore your Sustainability Journey.