What are science-based targets?

Science-based targets (SBTs) are greenhouse gas (GHG) emissions reduction targets that align with current climate science and the goals of the 2015 Paris Agreement, which aims to limit global warming to 1.5°C above pre-industrial levels. Official SBTs must be validated by the Science Based Targets initiative (SBTi) and adhere to the initiative’s strict criteria.

Clearly defined and backed by climate science, SBTs have grown in popularity over the past several years as a way for companies to demonstrate a solid commitment to reducing global emissions and mitigating the impacts of climate change. In addition, incorporating SBTs into your ESG program has become a key part of many ESG rating frameworks, such as CDP, and in many cases is a requirement for high performers. Consequently, these targets are a crucial part of any Sustainability Journey.

The Science Based Targets initiative

Established as a partnership between CDP, the UN Global Company, World Resources Institute (WRI), and the World Wide Fund for Nature (WWF), the Science Based Targets initiative (SBTi) works to help the private sector set and validate ambitious science-based targets. With its own set of specific criteria, SBTi validates science-based targets through a rigorous approval process, starting with a target application, conducting a thorough review, and providing feedback for companies that need to re-submit a revision.

Once approved, SBTs are publicly displayed and are often integrated into committed companies’ annual reports, sustainability reports, and other forms of disclosure, including CDP.

According to SBTi, 3278 companies have set SBTs, with more than 2300 others setting net-zero commitments for the near future. Companies that have set SBTs through SBTi include Lenovo, Macerich, Sony Group, Nissan Motor, Chipotle, and more—from tech companies and financial institutions to agricultural giants and airports.

Why set science-based targets?

Setting an SBT provides a science-backed guide for your emissions reduction strategy and program, giving you a specific, time-sensitive goal to work towards over the long and short term. To ease the process, SBTi provides some degree of guidance and feedback, and companies may also enlist the help of third-party consultants to provide individualized assistance from calculation to approval.

Having a validated SBT can also be a major reputational boost, demonstrating that your organization is a sustainability leader in its industry. Working with dozens of companies across sectors, our team has noted that many companies have begun developing SBTs and working to have targets approved before their competitors—one of many factors that help them differentiate from the crowd.

Taking a broader perspective, integrating ESG goals such as emissions reduction targets into an organization’s overall business strategy has been shown to help these organizations build resilience, giving them the flexibility to adapt to and prepare for climate-related risks as well as putting them in a better position to capitalize on opportunities. SBTi target approval is also included, recommended, or even required in other ESG frameworks, such as CDP.

What criteria do SBTs need to meet?

SBTi’s criteria for near-term targets are updated regularly and are summarized below.

1. Coverage

- Organizational boundary: Companies should submit targets at the parent- or group- level, rather than at the subsidiary level. It’s best to be consistent with the organizational boundary used in the company’s financial accounting and reporting.

- GHG coverage: Targets must cover company-wide greenhouse gas emissions as required by the GHG Protocol Corporate Standard.

- Scope coverage: All targets must cover scope 1 and 2 emissions. Targets must also cover scope 3 emissions if 1) relevant scope 3 emissions are 40% or more of total emissions, or 2) the company is involved in the sale or distribution of natural gas and/or fossil fuels.

- Emissions coverage: If 40% or more of a company’s total emissions are scope 3 emissions, that company is required to set a separate scope 3 target. These companies must set one or more targets that cover at least 67% of total scope 3 emissions.

2. Method

Targets must be modeled using up-to-date versions of SBTi-approved methods and tools.

3. Emissions accounting

SBTi has a number of specific emissions accounting requirements related to accounting approaches, scope 3 category screening, bioenergy accounting, and avoided emissions. The initiative also disallows the use of carbon credits toward the progress of a company’s SBTs.

4. Timeframe

Near-term targets must cover a minimum of five years and a maximum of ten years from the date of target submission. Targets that cover more than ten years are considered long-term targets. Base years must be no earlier than 2015. Near-term targets should be consistent with reaching net-zero by 2050 at the latest.

5. Ambition

Scope 1 and 2 targets must, at a minimum, be consistent with the level of decarbonization required to keep global temperature increase to 1.5°C compared to pre-industrial levels. For scope 3 targets, the minimum ambition is well below 2°C compared to pre-industrial levels. SBTi also lays out specific criteria for supplier engagement targets, combined targets, renewable electricity sourcing targets, and fossil fuel industry participants.

6. Reporting

Newly approved targets must be announced on the SBTi website within six months of approval.

On an annual basis, there should be full disclosure of the company-wide GHG emissions inventory and progress against targets.

7. Recalculation

Targets must be reviewed—and recalculated, if necessary—every five years at a minimum. Certain significant changes to a company’s GHG inventory, structure, and activities can also trigger a target recalculation.

8. Sector-specific criteria

SBTi maintains sector-specific requirements for certain sectors, including apparel and footwear, finance, buildings, chemicals, oil and gas, transport, and others. We dive deeper into sector-specific criteria in this post on SBTi’s framework for financial institutions.

What are the established methods for setting SBTs?

There are two established approaches to setting a science-based target. SBTi recommends choosing a methodology that is most appropriate for your organization—that is, the method that results in lower emissions—rather than choosing the target method that is easiest to meet or calculate.

The absolute-based approach is a “one size fits all” method that aims to reduce GHG emissions by a set amount. According to SBTi, this is the most common approach to setting SBTs.

The sector-based approach takes sector differences into account when calculating targets, focusing on mitigating emissions from specific, carbon-intensive activities.

What are the steps to setting SBTs?

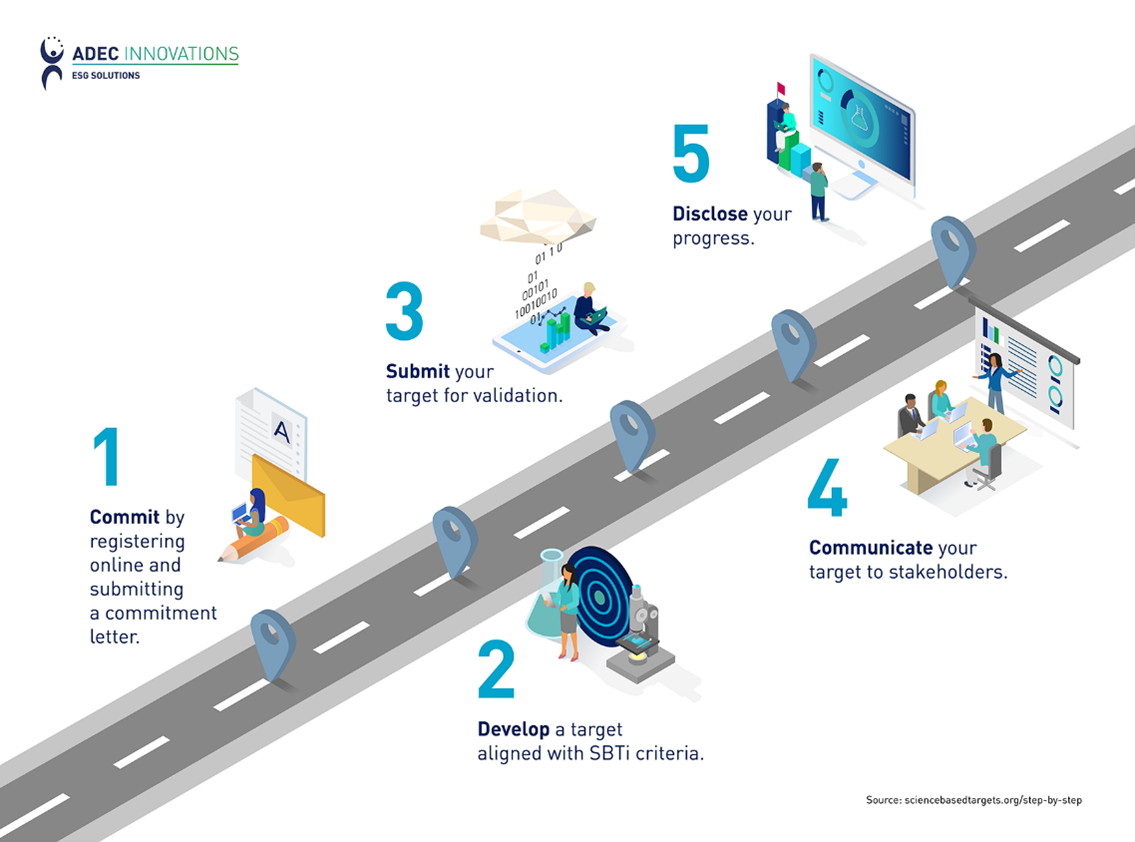

There are five main steps to setting an SBT receiving validation through SBTi.

1. Commit by registering online and submitting a commitment letter to SBTi. Once your letter has been submitted, you will have up to two years to develop and submit your target.

2. Develop a target aligned with SBTi criteria, including sector-specific requirements.

3. Submit your target for validation. Approval decisions may be made in weeks or months, and revisions may be necessary.

4. Communicate your target to your stakeholders once approved.

5. Disclose your progress annually, following SBTi’s requirements and guidance for reporting.

Science-based targets may take time to develop and validate, but they are one of the most commonly used targets in the ESG space for good reason. Aiming to encourage transformative action, SBTs are a great way to provide a clear pathway for your emissions reduction programs and set a course for success.

ADEC ESG Solutions works to help companies like yours successfully develop, submit, and validate science-based targets every day. Learn more about how we’ve supported companies in the chemical sector, real estate sector, and more on their emissions reduction and net-zero goals. Contact us today to learn more about how we can help.